Strategic and Innovation Value: Measuring What AI Makes Possible

Not every AI investment is about doing existing work faster or cheaper. Some of the most valuable AI applications create entirely new capabilities: the ability to analyze data that was previously inaccessible, to respond to market changes in real time rather than weeks later, or to explore product possibilities that were simply impossible to consider before.

This is the realm of strategic and innovation value, where AI doesn’t just improve current operations but fundamentally expands what an organization can do. It’s also where traditional ROI measurement fails most spectacularly. How do you calculate the return on being able to do something you couldn’t do before? How do you measure the value of speed when you’ve never operated at that speed?

This article provides frameworks for measuring these harder-to-quantify benefits. You’ll learn how to identify and articulate strategic AI value, use proxy metrics when direct measurement isn’t possible, calculate option value for capabilities that may or may not be exercised, and build business cases that capture innovation impact without resorting to hand-waving.

The organizations seeing the most value from AI aren’t just using it for efficiency. According to McKinsey’s 2025 State of AI report, 64% of respondents say that AI is enabling their innovation, and companies that set growth or innovation as objectives (not just efficiency) are more likely to be high performers. But measuring that innovation value requires different approaches than measuring cost savings.

Section 1: Why This Method Matters

The Strategic Value Gap

Most AI ROI discussions focus on operational metrics: time saved, errors reduced, costs cut. These are important and measurable. But they miss a significant portion of AI’s potential value; the strategic benefits that compound over time and create lasting competitive advantage.

Consider the difference between these two scenarios:

- Scenario A: An AI system automates invoice processing, saving $500,000 annually in labor costs.

- Scenario B: An AI system analyzes market signals in real time, enabling the company to adjust pricing and inventory before competitors, resulting in market share gains that would be nearly impossible to achieve otherwise.

Scenario A is straightforward to measure. Scenario B might be worth ten times more but is far harder to quantify. Yet organizations that focus exclusively on measurable efficiency gains may underinvest in the transformational applications that create durable competitive advantage.

What Makes Strategic Value Different

Strategic AI value differs from operational value in several important ways:

New Capabilities vs. Better Execution. Operational AI does existing tasks better. Strategic AI enables entirely new activities: analyzing unstructured data at scale, personalizing experiences for millions of customers simultaneously, or exploring thousands of design alternatives in hours rather than months.

Compounding Returns. Efficiency gains are typically linear and bounded. Strategic capabilities often compound: early insights inform better decisions, which generate more data, which enable better models, which produce even better insights. Organizations that establish AI-enabled capabilities early may create advantages that compound over time.

Competitive Positioning. Cost savings can often be replicated by competitors. Strategic capabilities (especially those built on proprietary data and organizational learning) may be more defensible. As one analysis noted, companies with access to proprietary data can create superior products and services that differentiate them in the market.

Option Value. Strategic AI investments often create options, the ability to pursue opportunities that may or may not materialize. A company with real-time market intelligence has the option to respond quickly; whether they exercise that option depends on circumstances. The value isn’t just in the specific outcomes but in the flexibility to act.

When to Focus on Strategic Value

Strategic and innovation value should be your primary measurement framework when:

- The AI application enables something genuinely new, not just faster or cheaper

- Competitive differentiation is the primary objective

- The project is exploratory or R&D-focused

- Value will emerge over longer time horizons (12-24+ months)

- The capability creates options for future opportunities

- Direct financial measurement would dramatically understate the investment’s importance

This approach complements rather than replaces operational measurement. Many AI projects deliver both strategic and operational value. The most compelling business cases often combine measurable efficiency gains with strategic upside.

Section 2: Stage 1 Idea/Concept – Defining Strategic Objectives

Articulating Strategic Intent

Before you can measure strategic value, you must define what strategic outcomes you’re pursuing. Vague objectives like “drive innovation” or “improve competitiveness” aren’t measurable. Specific objectives create measurement possibilities.

Strategic Objective Categories:

Speed to Market. Reducing the time from idea to launch, from data to decision, or from market signal to response. Research shows AI-enabled software development has accelerated product time to market by 5% across a six-month product development lifecycle in controlled studies, with some companies reporting reductions of 20-40%.

Decision Quality. Making better decisions through deeper analysis, better predictions, or access to previously unavailable information. IBM research found that organizations using AI-driven analytics report better decision-making capabilities, with executives making more accurate decisions in less time.

Innovation Throughput. Increasing the volume of experiments, prototypes, or new products. AI enables organizations to test more ideas and explore more possibilities within the same time and budget constraints.

Capability Building. Developing organizational muscles that enable future success. This includes AI literacy across the workforce, data infrastructure, and cross-functional AI expertise.

Market Position. Establishing leadership in AI-enabled products, services, or experiences that differentiate from competitors.

The Proxy Metrics Framework

When direct measurement isn’t possible, proxy metrics provide observable indicators of strategic value. The key is choosing proxies that have logical connections to the strategic outcomes you care about.

For Speed to Market:

- Time from concept to prototype

- Decision cycle time (time from data availability to decision)

- Research-to-insight conversion time

- Product development milestone velocity

For Decision Quality:

- Prediction accuracy rates

- Decision reversal frequency (how often decisions need to be changed)

- Stakeholder confidence in AI-informed decisions

- Coverage of decision-relevant factors in analysis

For Innovation Throughput:

- Number of experiments run per quarter

- Ideas evaluated per investment dollar

- Design iterations completed

- New product or feature pipeline growth

For Capability Building:

- Employee AI adoption rates

- AI literacy scores across teams

- New AI use cases proposed by business units

- Cross-functional AI project collaboration

Calculating Option Value

Some strategic AI investments are best understood as options, the right but not obligation to pursue future opportunities. Traditional ROI calculations often undervalue these investments because they focus on expected cash flows rather than optionality.

Option Value Framework:

Option Value = Probability of Exercise × Value if Exercised × Time Window Factor

Example: Real-Time Market Intelligence Platform

A retailer invests in an AI system that monitors competitor pricing, social media trends, and supply chain signals in real time. The direct operational value is modest, the system costs $400,000 annually and enables perhaps $200,000 in reactive savings.

But the strategic option value is significant:

- Ability to respond within hours (vs. weeks) to competitor price drops: Maybe exercised 3-4 times per year, protecting $2-5 million in margin each time

- Early warning on supply chain disruptions: Prevents 1-2 stockouts annually worth $1-3 million each

- Rapid capitalization on viral trends: Captures 2-3 trending product opportunities worth $500K-2M each

The option value might be calculated as:

(4 × $3.5M × 80%) + (1.5 × $2M × 90%) + (2.5 × $1.25M × 60%) = $11.2M + $2.7M + $1.875M = $15.775M

This isn’t a precise calculation; it’s an estimate that makes explicit the strategic bets embedded in the investment. The point isn’t precision but structured thinking about upside potential.

Section 3: Stage 2 Pilot/POC – Proving Strategic Capability

Designing Innovation-Focused Pilots

Strategic AI pilots differ from operational pilots. You’re not just testing whether something works; you’re testing whether it enables genuinely new capabilities.

Key Pilot Questions for Strategic AI:

- Can we do something we couldn’t before? Not just faster or cheaper – genuinely new.

- How much faster/broader/deeper is our capability? Quantify the expansion of what’s possible.

- What decisions or actions does this enable? Connect capability to business outcomes.

- Would competitors benefit similarly? Assess differentiation potential.

- What would we need to exploit this capability fully? Understand organizational readiness.

Case Study: R&D Acceleration in Pharmaceutical Development

The pharmaceutical industry offers some of the most dramatic examples of AI-enabled innovation value. Traditional drug discovery takes 10-15 years and costs over $2 billion per approved drug, with a 90% failure rate in clinical trials.

AI is transforming these timelines. According to research published in late 2024, AI-designed drugs show 80-90% success rates in Phase I trials compared to 40-65% for traditional drugs. Development timelines are being reduced from 10+ years to potentially 3-6 years, with costs cut by up to 70% through better compound selection.

Pilot Metrics for R&D Acceleration:

- Target identification time: Traditional methods might take months; AI platforms can analyze genomic data and identify promising targets in hours

- Compound screening throughput: Virtual screening can evaluate millions of compounds compared to thousands via traditional methods

- Prediction accuracy: AI models predicting drug-target interactions, toxicity, and efficacy

- Novel insight generation: Number of non-obvious target/compound relationships identified

Case Study: Product Design Time Compression

Eaton Corporation, a $23.2 billion intelligent power management solutions provider, implemented generative AI to accelerate new product development. The results demonstrate how AI enables genuinely new capabilities rather than just incremental improvements.

Their generative AI system runs thousands of design iterations in minutes, proposing the top five designs that are then fed through high-fidelity simulation. The documented results include:

- 87% reduction in design time for an automated lighting fixture

- 65% reduction in design time for a high-speed gear

- 80% reduction in the weight of a liquid-to-air heat exchanger

As Eaton’s Senior Global Technology Manager of Digital Design and Engineering stated: “Eaton’s vision is to take our traditional design processes from months to minutes.”

The strategic value here is both time savings but also the ability to explore design spaces that were previously inaccessible, finding optimal solutions that human designers wouldn’t have discovered through traditional iteration.

Measuring Speed and Capability Expansion

Pilot measurement for strategic AI should capture both speed improvements and capability expansion:

Speed Metrics:

- Time to complete analysis: Before vs. after comparison

- Decision latency: Time from data availability to actionable insight

- Response time: Ability to react to external events

- Iteration cycles: Number of experiments or versions in fixed time

Capability Metrics:

- Analysis scope: Volume of data processed, breadth of factors considered

- Novel insights: Findings that wouldn’t have emerged from traditional methods

- Complexity handling: Ability to address multi-variable problems

- Personalization depth: Granularity of customer/product/process customization

Section 4: Stage 3 Scale/Production – Tracking Strategic Impact

From Capability to Outcome

At scale, measurement shifts from proving capability to tracking business impact. Strategic AI should connect to observable outcomes, even if the connection isn’t perfectly attributable.

Strategic Outcome Categories:

Time-to-Market Impact: Track product launch timelines, feature release velocity, and competitive response times. Research shows companies leveraging AI in their product development processes can reduce time-to-market by 20-40%.

Innovation Pipeline Health: Monitor the flow of ideas, prototypes, and products through development stages. AI should increase throughput at each stage. According to a 2025 ESG survey, 84% of companies using AI report that it is already accelerating their pace of innovation.

Market Position Indicators: Track market share, competitive win rates, customer perception, and analyst recognition. These lagging indicators reflect accumulated strategic advantage.

Organizational Learning: Measure the development of AI capabilities across the organization – skills, processes, and culture shifts that enable future AI success.

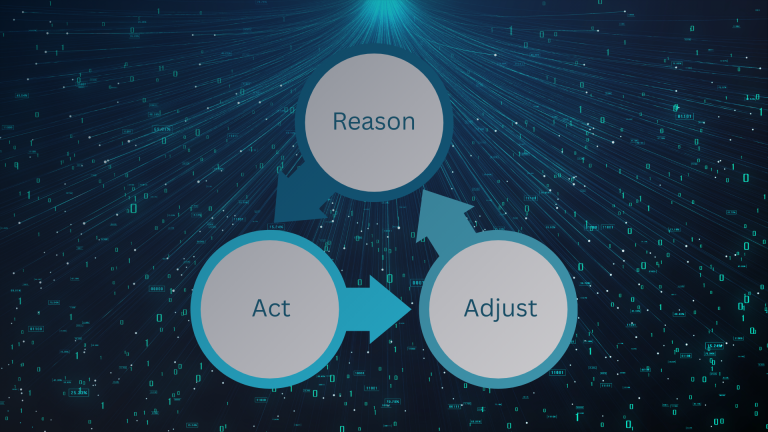

The Innovation Value Chain

Strategic AI value often flows through a chain of intermediate outcomes before reaching financial results. Understanding this chain helps you measure progress even before bottom-line impact materializes.

Stage 1: Capability Enhancement

- AI system operational and integrated

- Users trained and adopting

- New analyses or actions possible

Stage 2: Behavioral Change

- Different decisions being made

- New workflows established

- Speed of response changed

Stage 3: Operational Impact

- Product development accelerated

- Market opportunities captured

- Competitive responses improved

Stage 4: Financial Results

- Revenue from new products/markets

- Market share gains

- Valuation premium from strategic positioning

Measure progress at each stage. Early stages provide leading indicators before financial results materialize.

Platform and Compound Effects

Some strategic AI investments create platforms that enable multiple use cases. Measuring individual project ROI may miss the platform value.

Platform Value Indicators:

- Use Case Expansion: How many additional applications are enabled by the initial investment?

- Marginal Cost Reduction: Does each additional use case cost less to implement than it would standalone?

- Cross-Functional Adoption: Are multiple business units leveraging the same AI capabilities?

- Data Network Effects: Does usage of the system improve the system for all users?

Pfizer provides an instructive example. The pharmaceutical company developed its own generative AI platform called VOX, using it for everything from accelerating the identification of new treatment targets to creating first drafts of patent applications and automating marketing content development. They expect to save $1 billion annually from generative AI use cases in production, but the platform value extends beyond any single use case.

The company started laying the groundwork years ago: centralizing data, creating platforms to scale globally, and cultivating digital talent. They went from 10% of core IT in the cloud to 80%, migrating 12,000 applications and databases and 8,000 servers in just 42 weeks. This infrastructure investment enables compound returns across many AI applications.

Section 5: Stage 4 Continuous Monitoring – Sustaining Strategic Advantage

From Novel to Normal

Strategic AI capabilities have a natural lifecycle. What starts as competitive differentiation eventually becomes table stakes as competitors adopt similar approaches. Monitoring should track where you are in this cycle and when reinvestment is needed.

Competitive Position Monitoring:

- Capability Gap: What can you do that competitors cannot? Is this gap widening or narrowing?

- Adoption Curve Position: Are you still early, or has the capability become common?

- Customer Expectation Shifts: Are customers beginning to expect what you provide, rather than viewing it as differentiation?

- Market Standard Evolution: Is your innovation becoming the new baseline?

This isn’t necessarily bad; it may indicate you’ve successfully changed the market. But it signals that continued strategic value requires the next wave of innovation, not maintenance of current capabilities.

The Innovation Reinvestment Cycle

Strategic AI value is not a one-time achievement but an ongoing capability. Leading organizations reinvest continuously to maintain strategic advantage.

Reinvestment Triggers:

- Competitors launching similar capabilities

- New AI techniques emerging that could enhance your approach

- Data assets growing that could fuel improved models

- Customer expectations rising beyond current capabilities

- Adjacent opportunities emerging that current platform could address

Research from Deloitte’s 2025 analysis found that strategy innovation leaders (organizations most mature in executing AI-enabled innovation) report higher tech investment ROI, winning across both foundational and emerging technologies. They attribute over 40% of their enterprise value to digital initiatives and recognize more than 40% in latent potential for future growth.

Critically, these leaders’ ability to build a strong innovation culture appears to be rooted in deep engagement from technology leadership, a commitment to holistic and regular value measurement, a willingness to invest in AI for long-term outcomes, and spending more than peers on monetization and AI automation.

Section 6: Common Pitfalls

Pitfall 1: Confusing Activity with Strategic Value

Building AI capabilities isn’t the same as creating strategic value. Many organizations invest heavily in AI infrastructure and talent without clear connections to competitive advantage.

Warning Signs:

- Multiple AI projects running without clear strategic objectives

- Success measured by model accuracy or technical metrics rather than business outcomes

- AI team isolated from business strategy

- “Innovation theater” – visible AI activity without substantive impact

Correction: Every strategic AI initiative should have explicit connections to competitive advantage, customer value, or market position. If you can’t articulate how the AI capability translates to business outcomes, the investment may be activity rather than strategy.

Pitfall 2: Claiming Innovation Without Measurement

The difficulty of measuring strategic value sometimes leads organizations to skip measurement entirely, relying on narratives about “innovation” and “transformation” without evidence.

Warning Signs:

- Business cases built on qualitative claims with no metrics

- Progress reports that tell stories without data

- No baseline established before implementation

- Success criteria defined retroactively based on whatever happened

Correction: Strategic value can be measured, even if imperfectly. Use proxy metrics, leading indicators, and structured estimates. The discipline of measurement forces clarity about what you’re actually trying to achieve.

Pitfall 3: Ignoring Opportunity Cost

Strategic AI investments compete with other uses of capital, talent, and attention. Focusing only on the potential upside ignores what you’re giving up.

Warning Signs:

- Strategic AI projects evaluated in isolation rather than against alternatives

- No consideration of non-AI approaches to same strategic objectives

- Resource constraints treated as infinite

- Time and attention costs not factored into decisions

Correction: Ask: Could we achieve similar strategic outcomes through different investments? What are we not doing because we’re doing this? A strategic AI investment should outperform alternative uses of the same resources.

Pitfall 4: Vague Success Criteria

Strategic AI projects with vague success criteria become impossible to evaluate. Without clear criteria, any outcome can be rationalized as success or failure depending on the narrative.

Warning Signs:

- Objectives stated as “improve” or “enhance” without specific targets

- No defined timeline for expected outcomes

- Success criteria that could be claimed regardless of actual results

- Disagreement among stakeholders about what success looks like

Correction: Define specific, time-bound success criteria before implementation. Even if criteria are proxy metrics or leading indicators, they should be concrete enough that you can objectively assess whether they’ve been achieved.

Pitfall 5: Underestimating Time to Value

Strategic AI value typically emerges over longer time horizons than operational AI. Organizations that expect quick returns may kill strategic initiatives before value materializes.

Warning Signs:

- Strategic projects evaluated on same timelines as operational projects

- Pressure to show ROI before capability is fully deployed

- Expectations of immediate competitive advantage

- Quarterly review cycles mismatched with multi-year strategic horizons

Correction: Set realistic timelines for strategic value realization. Use leading indicators and intermediate milestones to track progress. Ensure governance structures account for longer time horizons.

Section 7: Key Takeaways

Core Principles for Strategic Value Measurement

Define specific strategic outcomes upfront. Vague objectives produce vague results. Articulate exactly what strategic advantage you’re pursuing: speed, capability, market position, or option value. Each requires different measurement approaches.

Use proxy metrics when direct measurement isn’t possible. Strategic value often resists precise quantification. Identify observable indicators that correlate with strategic outcomes. Time-to-market, innovation throughput, and capability metrics provide evidence even when financial impact is deferred.

Account for option value explicitly. Strategic AI investments often create the ability to pursue opportunities that may or may not materialize. Structure your analysis to capture this optionality, even if estimates are rough.

Track the full innovation value chain. Strategic value flows through stages: capability → behavior → operations → financials. Measure progress at each stage. Early indicators provide evidence before bottom-line results appear.

Plan for 12-24+ month horizons. Strategic AI value typically requires longer time horizons than operational value. Set expectations accordingly and use intermediate milestones to demonstrate progress.

Combine strategic and operational metrics. Most AI projects deliver both strategic and operational value. The strongest business cases combine measurable efficiency gains with strategic upside potential.

The Strategic Value Framework

Stage 1 (Idea/Concept): Define specific strategic objectives. Identify proxy metrics that will indicate progress. Calculate option value where appropriate. Establish baselines for capability and speed metrics.

Stage 2 (Pilot/POC): Prove capability expansion – can you do things you couldn’t before? Measure speed improvements. Document novel insights or outcomes. Assess competitive differentiation potential.

Stage 3 (Scale/Production): Track business impact through the innovation value chain. Measure platform effects and cross-functional adoption. Monitor market position indicators. Quantify innovation throughput.

Stage 4 (Continuous Monitoring): Assess competitive position and capability gaps. Monitor transition from differentiation to baseline. Identify reinvestment triggers. Plan next wave of strategic innovation.

Typical Strategic Value Drivers

R&D and Product Development: AI-enabled research acceleration can compress timelines from years to months. Companies report 20-40% reductions in time-to-market, with some cases (like Eaton’s 87% design time reduction) showing even more dramatic improvements. The strategic value lies in exploring more options and reaching market before competitors.

Market Intelligence: Real-time analysis of competitive, customer, and market signals creates option value – the ability to respond quickly when opportunities or threats emerge. Value is often realized through specific incidents rather than steady-state improvements.

Decision Quality: AI-augmented decision-making can improve outcomes across the organization. Research shows 47% of employees using AI save more than an hour daily, with 44% spending that time on strategic tasks. The compounding effect of better decisions creates strategic advantage.

Capability Building: Early AI adoption builds organizational muscles (data infrastructure, AI literacy, cross-functional collaboration) that enable future initiatives. This platform value often exceeds the value of any single application.

Typical ROI Realization: 12-24+ months for full strategic value. Leading indicators and capability metrics should show progress within 3-6 months. Organizations should expect the J-curve pattern: initial investment followed by accelerating returns as capabilities compound.

Sources

- McKinsey: The State of AI in 2025 – https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

- IBM: How to Maximize ROI on AI in 2025 – https://www.ibm.com/think/insights/ai-roi

- PwC: In the Age of AI – Speed Matters More, Scale Matters Less – https://www.pwc.com/us/en/tech-effect/ai-analytics/competing-in-age-of-ai.html

- California Management Review: Competitive Advantage in the Age of AI – https://cmr.berkeley.edu/2024/10/competitive-advantage-in-the-age-of-ai/

- Deloitte Insights: AI and Tech Investment ROI – https://www.deloitte.com/us/en/insights/topics/digital-transformation/ai-tech-investment-roi.html

- ISACA: How to Measure and Prove the Value of Your AI Investments – https://www.isaca.org/resources/news-and-trends/newsletters/atisaca/2025/volume-5/how-to-measure-and-prove-the-value-of-your-ai-investments

- McKinsey: How Generative AI Could Accelerate Software Product Time to Market – https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/how-generative-ai-could-accelerate-software-product-time-to-market

- aPriori: Eaton Case Study – Generative AI Cuts Product Design Time by 87% – https://www.apriori.com/resources/case-study/eatons-generative-ai-cuts-product-design-time-by-87/

- ScienceDirect: Leading AI-Driven Drug Discovery Platforms 2025 – https://www.sciencedirect.com/science/article/abs/pii/S0031699925075118

- Lifebit: AI Driven Drug Discovery – https://lifebit.ai/blog/ai-driven-drug-discovery/

- CIO: What CIOs Need to Know About Measuring AI Value – https://www.cio.com/article/4032809/what-cios-need-to-know-about-measuring-ai-value.html

- Hackett Group: The Acceleration of Generative AI – https://www.thehackettgroup.com/insights/the-acceleration-of-generative-ai-how-businesses-are-scaling-for-competitive-advantage/

- Writer: AI ROI Calculator 2025 – https://writer.com/blog/roi-for-generative-ai/

- World Economic Forum: 2025 The Year Companies Prepare to Disrupt How Work Gets Done – https://www.weforum.org/stories/2025/01/ai-2025-workplace/

- Vena Solutions: 100+ AI Statistics Shaping Business in 2025 – https://www.venasolutions.com/blog/ai-statistics

- Snowflake: Mind The Value Measurement Gap – https://www.snowflake.com/en/blog/value-measurement-impact-ai-investements/

- BDO: AI ROI – A Pragmatic Measurement Guide – https://www.bdo.be/en-gb/insights/articles/2025/ai-roi-a-pragmatic-measurement-guide

- Relevance Lab: How GenAI and Automation Drive Down Costs and Speed Up Innovation – https://www.relevancelab.com/post/genai-automation-cost-innovation

- Google Cloud: AI’s Impact on Industries in 2025 – https://cloud.google.com/transform/ai-impact-industries-2025

- IBM: AI in Product Development – https://www.ibm.com/think/topics/ai-in-product-development